A Creator’s Guide to Podcast Monetisation: Insights from a $2.4B Industry Evolution

Some market insights on emerging monetisation strategies, programmatic advertising growth, and platform diversification tactics for creators to build sustainable revenue streams in 2025 and beyond

Executive Summary

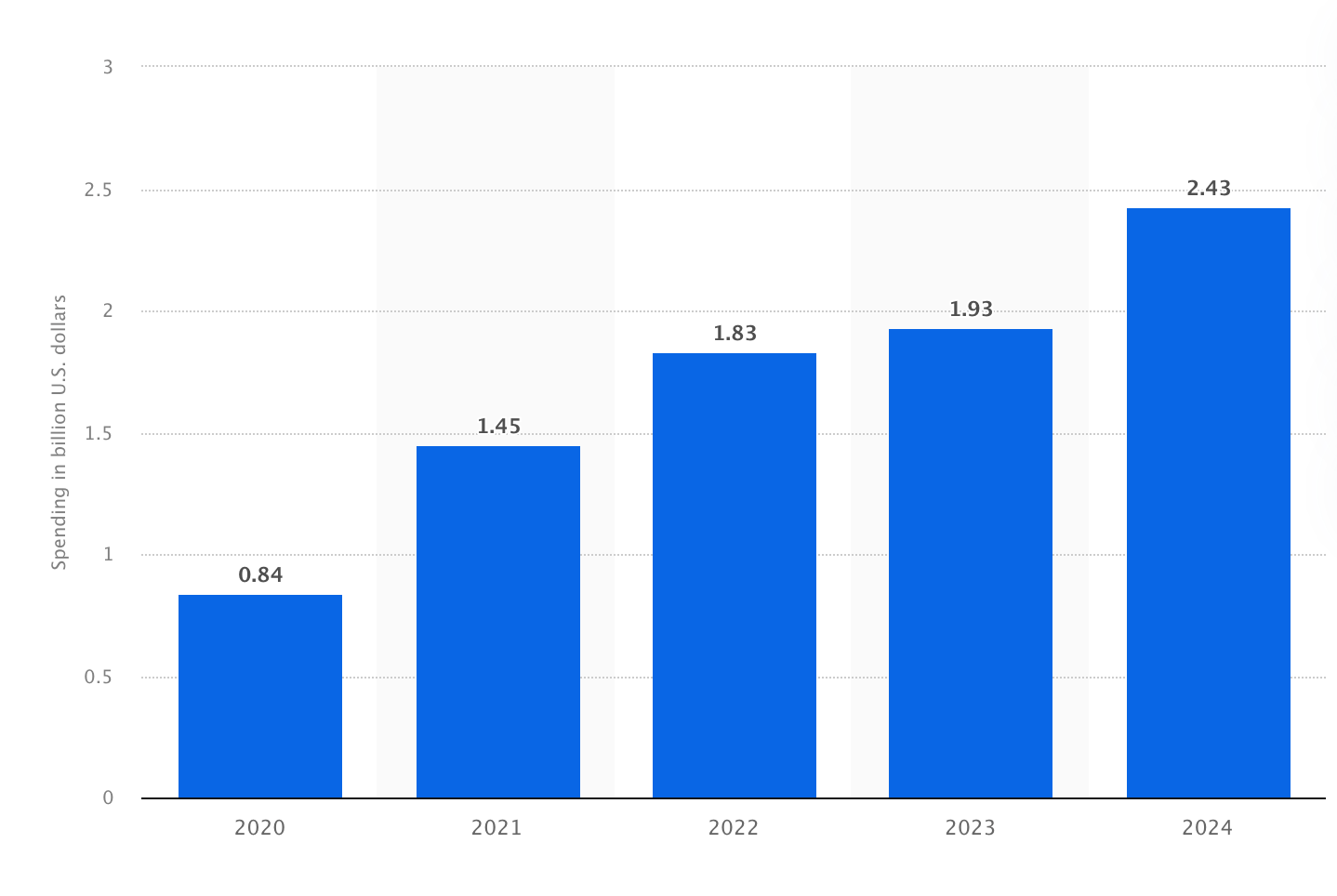

The podcast advertising landscape has fundamentally transformed from a $0.84B market in 2020 to a $2.43B powerhouse in 2024, with creators now positioned to capture unprecedented revenue through diversified monetisation strategies that extend far beyond traditional host-read ads.

The data reveals a maturing ecosystem where smart creators who understand the new monetisation playbook can build sustainable six and seven-figure businesses, regardless of audience size.

The growth of advertising spend on podcasts (US data)

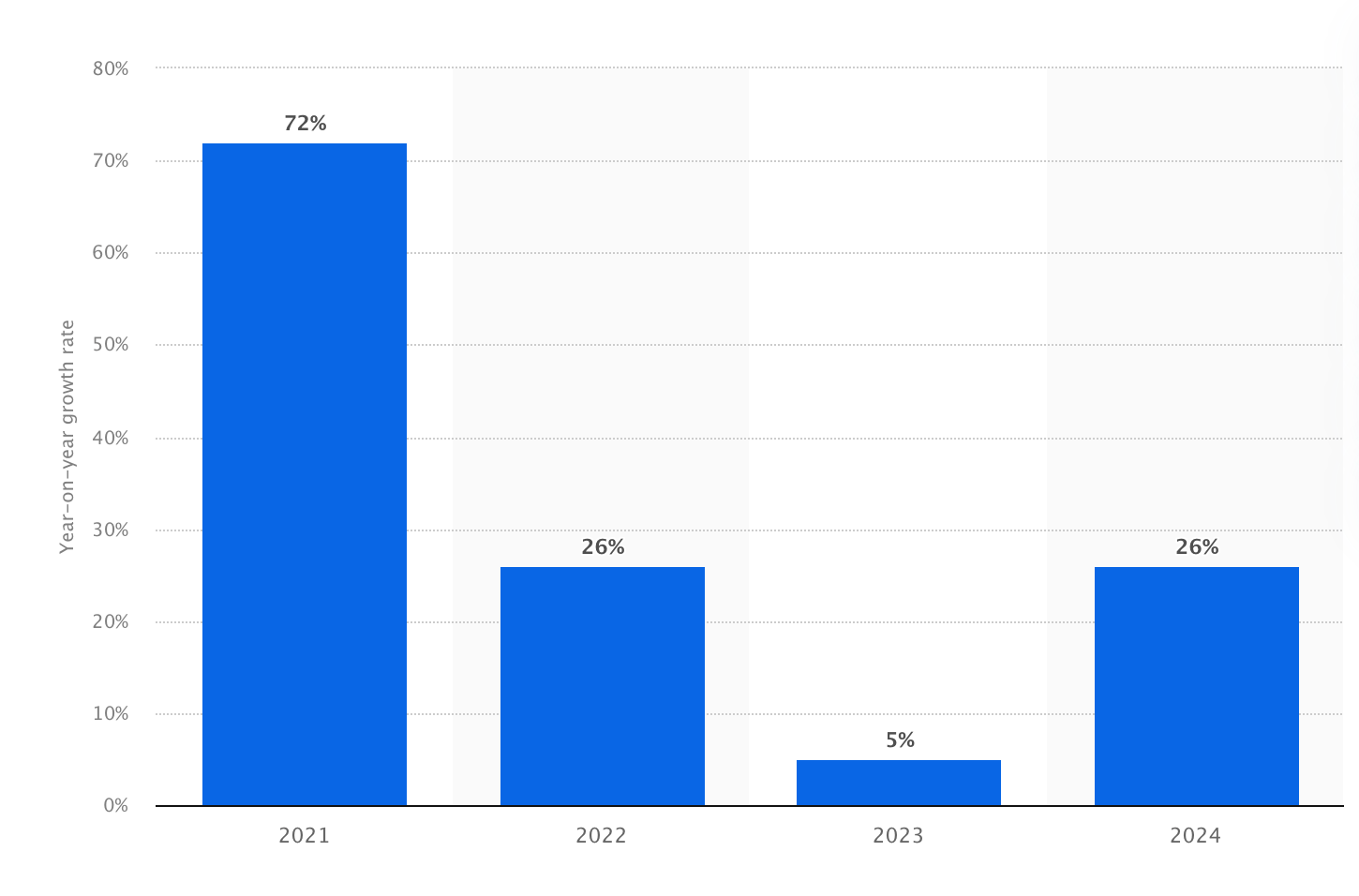

The rate of growth of advertising spend on podcasts (US data)

Few takeaways:

Podcast ad spending nearly TRIPLED from $0.84B in 2020 to $2.43B in 2024. While growth rates are normalising after the 72% pandemic boom, the 26% rebound in 2024 shows the market is far from saturated. Creators: the money is still flowing in

The 2023 slowdown (5% growth) was just a market correction, not a collapse. With 2024 bouncing back to 26% growth, smart creators who stayed consistent during the “slow” year are now positioned to capture more of that $2.43B pie

Here’s the creator opportunity: As growth rates mature from explosive (72%) to steady (26%), the market is shifting from “spray and pray” to strategic partnerships. Brands want proven audiences, not just big numbers. Quality content > vanity metrics

$2.43B in 2024 podcast ads means there’s roughly $200M+ flowing monthly to creators and networks. Even at “slower” 26% growth, that’s an extra $40M+ in new creator opportunities each month

The maturation curve is creator gold: Early explosive growth (2020–2021) rewarded first-movers. Now steady growth (2024+) rewards consistency and niche expertise. If you’re just starting your podcast, you’re entering a $2.4B+ market that’s still expanding

Now let us look at some more global macro data

The global podcast advertising market reached $4.46 billion in 2025, representing a 10.95% increase from 2024, with projections showing continued growth to $5.03 billion by 2027. This isn’t just another tech bubble — it represents a fundamental shift in how audiences consume media and how brands allocate their marketing budgets. In the U.S. specifically, podcast ad spending started 2025 with remarkable momentum, posting 23% growth in January and 25% growth in February year-over-year, according to Magellan AI’s tracking data.

What makes this growth particularly compelling for creators is the breadth of new market entrants. During Q3 2024 alone, 1,438 new brands entered the podcast advertising space, each spending an average of $25,900 across the quarter. This isn’t just established Fortune 500 companies doubling down on podcasts — it’s a massive expansion of the advertiser base that includes everything from local businesses to emerging direct-to-consumer brands. The beauty of this trend is that it creates opportunities for podcasters across every niche and audience size, from true crime shows to business podcasts to comedy series.

The market’s maturation is evident in how advertising loads have evolved. Analysis from Radio Ink shows that 8.6% of podcast episode time was dedicated to advertising in 2024, a 35% increase from 6.38% in 2023. This translates to approximately 79 seconds per episode, but rather than alienating listeners, engagement metrics continue climbing. This suggests that audiences have not only accepted podcast advertising but are actively engaging with it when it’s relevant and well-integrated into the content they love.

The Maturation Curve Creates Creator Gold

The evolution from explosive growth rates of 72% in 2021 to the more sustainable 26% expansion in 2024 isn’t a market slowdown — it’s evidence of a maturing ecosystem that now rewards quality, consistency, and strategic thinking over viral moments and vanity metrics. This shift fundamentally changes the creator opportunity landscape in ways that favor thoughtful podcasters who understand their audience deeply.

Industry research from Cumulus Media reveals a striking opportunity gap: podcasts represent only 1% of total national advertising spend despite driving the majority of audio audience growth. This massive disconnect suggests that the next phase of growth will come from advertiser budget reallocation rather than just audience expansion. The legendary media strategist Arnie Semsky’s “5% solution” recommended that brands allocate 5% of their digital budgets to cable TV during its early growth phase. Today’s podcast landscape presents a similar inflection point, with industry experts advocating for a similar 5% allocation to podcasting.

The implications for creators are profound. As major brands begin shifting larger portions of their media budgets into podcasting, there will be increased competition for premium inventory, driving up CPMs and creating more opportunities for mid-tier podcasters to access brand partnerships that were previously reserved for the largest shows. The data shows that while brands currently spend 72% of their marketing budgets on digital campaigns, only 3% goes toward podcast advertising, with the biggest chunks going to digital video (20%), social media (16%), and digital display (14%). This imbalance represents billions of dollars in potential budget shifts toward audio content.

The $211.9 Million Programmatic Breakthrough

Programmatic advertising in podcasting has crossed a critical threshold, reaching 9.3% of U.S. podcast ad spend in 2024 and totaling $211.9 million in automated ad transactions. This represents more than just a technological advancement — it’s a fundamental restructuring of how podcast monetization works, shifting from labor-intensive, one-to-one sponsorship negotiations to scalable, data-driven revenue streams that can operate 24/7 without direct creator involvement.

The programmatic revolution solves one of the biggest challenges facing podcast creators: the inability to scale revenue without proportionally scaling time investment. Traditional podcast sponsorships require creators to personally negotiate deals, read ads, and manage advertiser relationships. As Spotify’s adoption of programmatic solutions demonstrates, with their Ad Exchange seeing 60% growth since spring 2024, the industry is rapidly moving toward automated systems that can deliver targeted, relevant ads without requiring manual intervention from creators.

What makes programmatic particularly powerful for creators is the sophistication of modern targeting capabilities. Unlike traditional banner ads that rely on basic demographic data, podcast programmatic advertising leverages behavioral signals, listening patterns, and contextual information to deliver highly relevant messages. AdsWizz reports that their platform now combines Comscore’s audience personas with behavioral signals from NumberEight’s data platform, unlocking access to over 300 unique audience profiles for privacy-compliant, hyper-relevant ad delivery at scale.

AI-Powered Host-Read Ads at Scale

The most exciting development in podcast monetisation is the emergence of AI-powered solutions that enable host-read ads at scale through voice cloning technology. Companies like ekoz.ai are pioneering systems where podcast hosts can opt to clone their voice, creating an “eko” that can deliver personalised ad reads without requiring the host’s direct involvement in every campaign.

This technology preserves the authenticity and trust that makes host-read ads 55% of podcasting ad revenue while eliminating the time constraints that previously limited creator earning potential. The process is remarkably sophisticated: AI generates scripts from advertiser talking points, personalizes them for each host’s style and audience, creates the ad in the host’s actual voice, and requires host approval before delivery. This maintains editorial control while dramatically expanding monetization opportunities.

The implications extend far beyond just scaling ad reads. Triton Digital’s partnership with ekoz.ai demonstrates how major podcast infrastructure companies are investing in solutions that help creators access premium campaigns without additional workload. For creators, this means the ability to maintain multiple revenue streams across different shows, time zones, and advertiser categories simultaneously.

YouTube Becomes the Podcast Ecosystem

The most significant shift in podcasting isn’t happening in traditional audio apps — it’s occurring on YouTube, which has become the most frequently used service for podcast consumption in the United States. This platform transformation represents more than just another distribution channel; it’s fundamentally changing how creators can monetize their content and engage with audiences across multiple touchpoints.

YouTube’s dominance in podcast consumption is driven by compelling statistics: viewers are watching over 400 million hours of podcasts per month on televisions alone, 46% of regular listeners prefer video with their audio, and more than 70% of viewers watch video podcasts in the foreground rather than as background content. This level of visual engagement creates monetization opportunities that simply don’t exist in pure audio formats.

The revenue implications for creators are substantial. YouTube’s monetization ecosystem includes traditional ad revenue sharing, YouTube Premium subscriber revenue distribution, channel memberships, Super Thanks donations, Super Chat during live streams, merchandise integration through Shopping Collections, and affiliate marketing opportunities. But the platform’s real power lies in its recommendation algorithm and cross-platform discovery capabilities. Research from SweetFish Media shows that YouTube’s algorithm can help podcasters break into international markets and reach cross-generational audiences through visual storytelling that resonates universally.

The Multi-Platform Revenue Strategy

What separates successful video podcasters from their audio-only counterparts isn’t just the additional revenue streams — it’s the compound effect of cross-platform audience growth. When creators publish video content on YouTube while maintaining their audio presence on traditional podcast platforms, they create multiple discovery paths for the same content. A listener might discover a show through Apple Podcasts, become a regular audio subscriber, then migrate to YouTube for the visual experience, eventually joining a paid membership community for exclusive content.

Spotify’s recognition of this trend led to their introduction of new monetization methods including both ad and premium video revenue through their Partner Program for Creators. This means creators can now earn revenue from Spotify Premium subscribers who don’t see ads, creating a diversified income stream that captures value from both ad-supported and subscription-based listeners.

The technical capabilities supporting video podcasting have also evolved dramatically. Dynamic ad insertion technology now supports video ads that can be targeted and placed even after publication, while comprehensive analytics platforms like Chartable and Podtrac provide cross-platform insights that help creators optimize their content strategy across all distribution channels.

The Billion-Dollar Creator Economy

The podcast creator economy has reached a critical mass that eMarketer projects will generate more than $1 billion in revenues during 2025, with time spent listening to podcasts surpassing TikTok consumption among adult users. This milestone isn’t just about total market size — it represents the maturation of podcasting from a hobby-driven medium into a legitimate career path for content creators who understand how to build sustainable business models around their shows.

The most successful creators aren’t limiting themselves to traditional advertising revenue. They’re building comprehensive media companies that leverage their podcast as the cornerstone of much larger business ecosystems. Analysis of top-performing podcasts reveals that 53% monetize through paid communities, demonstrating the power of exclusive content strategies that create recurring revenue streams independent of advertiser spending patterns.

This diversification isn’t just a hedge against advertising market volatility — it’s often more profitable than traditional sponsorships. Creators building premium subscription models can capture significantly higher lifetime value from their most engaged listeners. A creator with 10,000 downloads per episode might earn $500–1,000 from a traditional sponsorship, but 100 premium subscribers paying $10 monthly generates $1,000 in recurring revenue that compounds over time.

Live Events and Experiential Marketing

The live events sector of podcast monetisation represents one of the fastest-growing opportunity areas, with research showing that 15% of listeners are willing to pay between $10–25 to attend live-recorded podcast events, and 13% have already attended such experiences. These aren’t just revenue opportunities — they’re community-building exercises that deepen the relationship between creators and their most dedicated fans.

Acast’s partnership with Sunglass Hut to host Naked Beauty’s first live show in Los Angeles demonstrates how brands are investing in experiential campaigns that combine live events with multi-platform content strategies. The event included a one-of-a-kind live recording in-store complete with a digital photo booth, co-branded merchandise, and mini makeovers. For attendees, it provided exclusive access to their favorite podcaster’s first live show, while for the brand, it compressed the marketing funnel from awareness to purchase among live show participants.

The scalability of live events has been enhanced by technology platforms that enable virtual attendance, hybrid experiences, and recorded content that can be monetized long after the initial event. Creators are discovering that live events often generate multiple revenue streams: ticket sales, exclusive merchandise, premium access tiers, sponsor partnerships, and recorded content that can be sold to audiences who couldn’t attend in person.

E-commerce Integration and Product Development

Video podcasting has unlocked entirely new monetisation categories through visual product placement, interactive shopping experiences, and seamless e-commerce integration. Unlike traditional audio ads that require listeners to remember and later search for products, video podcasts can include clickable links, QR codes, and real-time purchasing options that eliminate friction from the conversion process.

The most sophisticated creators are developing their own product lines specifically for their audiences. These range from physical merchandise that serves as both revenue generation and community building to digital products like courses, templates, and exclusive content libraries. Shopify’s analysis of creator monetisation shows that digital products often provide the highest profit margins, with some creators generating $50,000 from 25,000 monthly viewers through strategic product development.

What makes podcast-driven e-commerce particularly powerful is the trust and authority that creators build with their audiences over time. When a podcast host recommends a product or shares their own creation, it carries significantly more weight than traditional advertising because listeners have developed a personal relationship with the creator through hours of shared audio experiences.

Strategic Implementation: The Creator Playbook

The biggest mistake new podcasters make is waiting until they have a large audience to begin monetisation experiments. Research demonstrates that shows with fewer than 1,000 downloads can still generate six-figure revenues through strategic monetisation approaches that focus on audience quality over quantity.

For emerging creators, the focus should be on building multiple small revenue streams that can compound over time. Niche podcasts in specialised industries often command premium advertising rates, with tech podcasts earning $45–60 CPM and B2B shows reaching $65–85 CPM according to monetisation studies. These higher rates reflect the value that specialised audiences provide to targeted advertisers.

The key during this stage is experimentation and audience development. Platforms like Ko-fi work well for smaller audiences because they don’t charge platform fees, allowing creators to keep 100% of listener donations. Digital products can be particularly effective because they don’t require large audience sizes to generate meaningful revenue — a well-designed course or template set can provide value to even a small, highly engaged community.

Growth Stage: Diversification and Optimisation (1K-10K Downloads)

Once creators reach sustainable download numbers, the focus shifts to revenue diversification and system optimisation. This is the stage where programmatic advertising becomes viable through hosting platforms that support dynamic ad insertion. Creators should also begin serious video content development, as YouTube’s monetisation potential often exceeds traditional podcast advertising revenue for shows in this size range.

The growth stage is also when creators should begin building their own platforms and communities outside of traditional podcast distribution. This might include email newsletters, social media communities, or dedicated membership platforms that provide more direct access to their most engaged listeners. The goal is to create owned media channels that aren’t subject to platform algorithm changes or policy updates.

Analytics become crucial during this phase. Creators need detailed insights into listener behaviour, engagement patterns, and conversion metrics across all their revenue streams. This data informs content strategy, advertising negotiations, and product development decisions that can dramatically impact overall profitability.

Scale Stage: Enterprise and Partnership Development (10K+ Downloads)

At scale, successful podcast creators are essentially running media companies with multiple revenue streams, strategic partnerships, and sophisticated audience development strategies. The average advertiser spent $329,000 per month on podcast ads in 2024, with $5.10 of every $10 going to the top 500 podcasts, demonstrating the premium that advertisers place on established, high-performing content.

Creators at this level should be implementing omni-channel marketing strategies that leverage their podcast content across audio, video, social media, email, and live experiences. They’re also typically developing their own products, services, or media properties that can generate revenue independent of advertising market conditions.

The most sophisticated creators are building strategic partnerships with other media companies, technology platforms, and even traditional businesses that can provide distribution, resources, or co-creation opportunities. These partnerships often involve revenue sharing arrangements, cross-promotion deals, or equity stakes in complementary businesses.

The Technology-Human Balance Revolution

According to Bryan Barletta, founder of Sounds Profitable, the podcast industry’s maturation is creating unprecedented flexibility for both creators and advertisers: “The entire industry is aligned that there is no one way to buy podcast ads, and that’s a good thing. Our tech is stronger than ever. Our metrics are tighter than ever.” This philosophy of technological enhancement rather than replacement is driving innovations that scale human creativity rather than replacing it.

The shift toward what industry insiders call a “yes and” mindset means that creators no longer need to choose between host-read ads and programmatic placements, between audio and video content, or between advertising and direct monetization. The most successful creators are implementing hybrid strategies that combine multiple approaches based on audience preferences, content formats, and revenue optimization goals.

The Omnichannel Creator Economy

Acast’s Executive Producer Shantae Howell predicts a fundamental expansion of what podcast advertising means: “In 2025, podcast ads won’t just be heard; they’ll be seen, experienced, and remembered” through creator-led, omnichannel campaigns that span audio, video, social media, and live experiences.

This evolution recognizes that modern audiences don’t consume content in isolation — they engage with creators across multiple platforms and touchpoints throughout their day. The most effective monetization strategies will create cohesive experiences that feel natural whether someone encounters the creator through a podcast, YouTube video, Instagram post, or live event.

The implications for creator business models are significant. Instead of monetizing individual podcast episodes, creators are building comprehensive entertainment and education experiences that can generate revenue through multiple channels simultaneously. A single piece of content might generate advertising revenue through traditional podcast ads, YouTube monetization, social media partnerships, premium subscriber content, and live event ticket sales.

AI-Driven Optimisation and Personalisation

Valerie Reimer, VP of Ad Tech & Product Partnerships at Acast, believes artificial intelligence will fundamentally transform podcast monetisation: “AI will play a major role in expanding ad tech tools — what we’re seeing now is just the tip of the iceberg. AI-driven solutions can further enhance targeting, automate creative optimisation, and bring even more advanced real-time decision-making.”

The AI revolution in podcasting extends far beyond automated ad placement. Emerging technologies can analyse listener engagement patterns to optimise content structure, suggest ideal sponsorship integration points, and even generate personalised content variations that increase conversion rates. For creators, this means access to enterprise-level optimisation tools that were previously available only to major media companies.

Machine learning algorithms are also beginning to predict listener behaviour patterns, helping creators identify which audience segments are most likely to convert to premium subscribers, which content topics generate the highest engagement, and which monetisation strategies are most effective for specific audience demographics.

The Bottom Line: Seizing the Creator Advantage

The podcast advertising evolution has created a perfect storm of opportunity for creators who understand the new monetisation landscape. The transformation from a $0.84 billion market in 2020 to today’s $2.4 billion ecosystem represents more than just growth — it represents the maturation of podcasting into a legitimate business platform that rewards creativity, consistency, and strategic thinking.

The key insight driving successful creator businesses in 2025 isn’t about audience size — it’s about understanding and implementing diversified monetisation strategies that turn passionate listeners into paying customers across multiple touch-points. The creators building sustainable six and seven-figure businesses are those who recognise that their podcast is not their business; it’s the foundation of their business.

As the industry continues its trajectory toward the projected $100 billion podcasting market by 2030, the creators who position themselves strategically today will capture disproportionate value tomorrow. The combination of programmatic advertising growth, video platform integration, AI-powered optimisation tools, and direct monetisation opportunities has created more pathways to podcast profitability than ever before in the medium’s history.

The question isn’t whether creators can build profitable podcast businesses, but which creators will be smart enough to implement the strategies that transform their passionate audiences into thriving business ecosystems.

Primary Industry Sources: Acast • eMarketer • YouTube • SweetFish • Westwood • Backlinko • Triton